Over A Third Of Your Electric Bill Is Pure Corporate Profit

Sham "Capacity Charges", "Single Price Auction", And Corporate Profits Drove Huge Price Spike

Rigged Energy Market, Flawed Auction Process, And Captured Regulators Drive Skyrocketing Electric Bills

Solutions Involve Independent NJ Grid, Public Power, And Expanded Renewables

On June 1, electric bills for NJ consumers skyrocketed by 30% or more (just in time for the heat wave - wait till you see your AC bill!).

Governor Murphy, NJ Legislators, BPU, and the media have failed to explain why this is happening. They think people are stupid and they are hiding behind claims that it's all "very complex" and the result of PJM and federal issues that are not under NJ State control.

Instead they have diverted attention to misleading claims about alleged surging demands from AI data centers, the shutdown of old coal power plants, and an aging energy grid.

No doubt, these factors do influence energy prices, but they are not what drove the energy price spike and skyrocketing energy costs.

Here's the basic story - based on the NJ Board Of Public Utilities' Energy Master Plan, PJM data, and a report by the Rocky Mountain Institute, one the most expert energy industry analysts in the country.

For more in depth analysis of the PJM issues, I suggest the expert reporting by an outfit called "Utility Dive" (read all their articles here).

Let's break this down.

I) Components Of The Electric Bill

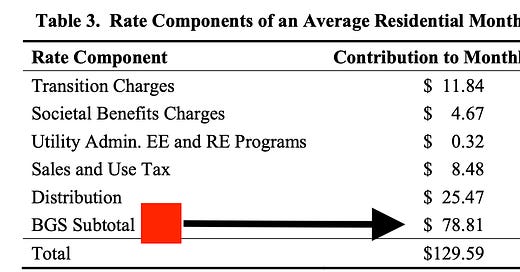

Here are the individual components of your electric bill, according to the NJ BPU Energy Master Plan.

The specific prices are used for illustrative purposes only - actual current prices are significantly higher. "BGS" is the energy generation component. Read the EMP for a more detailed explanation.

According to BPU, "Transition Charges" (9.1% of the total bill) provide significant corporate subsidies that were created in 1999 when the Legislature deregulated energy (see Table 5 in the EMP for an individual breakdown):

Transition and Other Charges consists of nine separate charges, most of which are related to electric deregulation in New Jersey. A number of these charges provide compensation to EDCs for electric generation assets and electricity supply contracts that were deemed “stranded”, i.e. uneconomic with the transition to competition.

These corporate subsidies can and should be eliminated by the Legislature. It's been 25 years since deregulation, so the "transition" is over. That's a 9.1 % reduction.

BGS is the power generation component, (61% of the total bill) . It is based on a power auction (see below for problems with that). Here are the elements of BGS:

Note that "PJM RPM Capacity" is $10.70, or 13.6% of the BGS component, or 8.3% of the total bill.

So called "capacity charges" do not pay for the costs of generating and transmitting power. They are a theoretical economic policy designed as an "incentive" (AKA a "subsidy") to corporate energy producers to guarantee that their power plants produce power and can be relied on to meet demand. These PJM charges are provided directly to corporate power producers and are pure profit.

In the old days of public utility regulation, corporate owners of power plants were required to invest in and properly maintain their plants so that they could reliably produce power to meet demand. If they failed to do so they were fined.

These PJM capacity charges skyrocketed by over 800% this year, so they are far more than 8.3% of the total bill.

Capacity charges are the single largest increase that is driving the price spike.

II) Corporate Profits Account For At Least 20%

According to a Report by the Rocky Mountain Institute (RMI), one of the nation's premier energy industry experts, corporate profits account for 15 - 20% of the electric bill:

ROE [return on equity] makes up 15%–20% of customer bills. Getting such a large piece of the affordability puzzle in line will save customers money. Misaligned ROEs included in utility rates can result in increases in customer bills and create investment incentives that deviate from policy goals.

RMI did not consider the PJM "capacity charges" and NJ "Transition Costs" in that 15 - 20% estimate. Both these charges are effectively corporate subsidies and corporate profits, so the actual corporate ROE is far larger than the RMI estimate.

III) PJM Capacity Charges Are Huge And A Sham

As I stated previously, "capacity charges" have nothing to do with the costs of generating and transmitting energy, they are an economic "incentive" (i.e. corporate subsidy) designed to attract private investment in energy generation.

Consider this most recent development, a $14.7 billion ripoff: (Utility Dive)

For the majority of the PJM region, capacity prices for the 2025/26 delivery year soared to $269.92/MW-day, up from $28.92/MW-day in the last auction, the grid operator said in an auction report. Prices hit zonal caps of $466.35/MW-day for the Baltimore Gas and Electric zone in Maryland, and $444.26/MW-day for the Dominion zone in Virginia and North Carolina. The auction’s total cost to consumers jumped to $14.7 billion from $2.2 billion in the last auction.

Capacity charges can be eliminated by the NJ Legislature by forming a NJ Independent Grid.

IV) Flawed Auction - The Price Of Energy Is Based On The HIGHEST PRICE BID BY THE MOST EXPENSIVE SOURCE OF POWER

Very few people understand how the PJM power auction actually works.

No need to take my word for it. Here's how PSE&G described the auction in a legal motion filed to the US Supreme Court.

PSEG explains this clearly – how the auctions lead to high prices and consumer ripoff even when they work as designed and are not rigged:

The price that each generator receives for the power it produces is not ordinarily established by its own bid. Wholesale markets operate on the principle of the “single market clearing price.” All generators are paid the same price based on the bid of the last unit that “cleared the market,” that is, the most expensive unit needed to meet demand.

Repeat: a "single market clearing price" is based on "the most expensive unit needed to meet demand."

This is a corrupt auction methodology and is driving high energy costs and corporate profits far beyond the RMI's 15 - 20% estimate.

V) SUMMARY

Conservatively, if you eliminate corporate profits (RMI, 20%) by creating a publicly owned power authority; eliminate NJ BPU "transition costs" (9.1%); eliminate PJM "capacity charges" (8.3%), and assume that the PJM auction "single market clearing price" inflates the real costs of generating power by 25% (the cost of generating power is about half of the monthly electric bill) that would cut another 12.5% from the monthly bill.

Summing these individual reductions shows that monthly energy bills could be reduced by 50% - that would save NJ consumer BILLIONS of dollars every year on energy costs!

Public Power And An Independent NJ Grid Are The Solution. EXIT PJM NOW!

Our next post will drill down and critique the explanations offered by public officials and a lame media.

We will then expose specific examples of how PJM is biased toward incumbent fossil generators; mismanages energy prices via manipulation of energy demand and energy supply; blocks and delays the transition to renewable energy; and operates secretly with no public accountability.

Sounds not unlike the way things are run here in Australia. It all changed during my years in Japan - from local town/shire-based operation - not for profit - to privateers rorting (as we say here in Australia) their more-or-less monopolistic control. Nearly all public instrumentalities sold off by state/federal governments to "the cowboy" operators! Kickbacks in various unseen ways - of course!